Health and Safety

We are committed to ensuring the health and safety of all our employees and stakeholders, and minimising our impact on the environment.

The Prax Group’s safety aspirations are encapsulated by the acronym PEAR:

- Zero harm to People

- Zero harm to the Environment

- Zero harm to Assets

- Zero harm to Reputation

Read more

We believe that all cases of work-related ill health, injuries and incidents are preventable and it is our policy that all near misses, however minor, are reported. This is a higher standard than is normally applied in this industry.

The Prax Group policy on occupational safety, health, environment and process safety requires the active involvement of all employees to ensure that continuous efforts are made to maintain and improve our performance and recognise our obligations under applicable international, national and local legislation and management standards.

At all our plants and offices, we are committed to take all reasonable measures to identify the potential for accidents, eradicating that potential and thus maintaining our goal of zero harm.

Environment

Our aim is to provide the highest standards in our products and services, and we manage our activities to minimise, wherever practicable, their effect on the environment. In this we are committed at all levels and within all functions of the Prax Group to continual improvement.

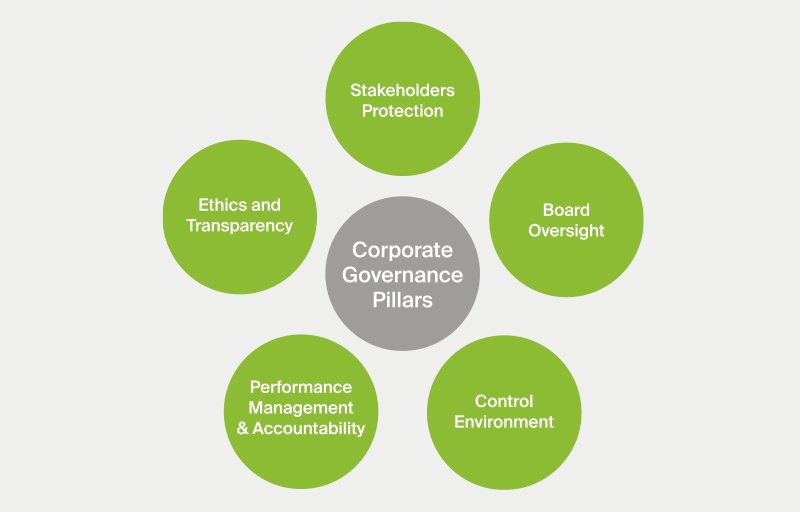

Governance

The Group operates robust corporate governance policies including anti-money laundering, anti-bribery and anti-slavery. It also employs stringent Know Your Customer (KYC) procedures on its counterparties. It is determined to create and maintain a business that is a force for good, through diversity and inclusivity.

Stakeholders Protection and Board Oversight

The Board of Directors meets regularly and, wherever possible, discusses policy, the market economy and strategy. It places corporate communication highly in its ethos and encourages it at all levels within the Group. The Group recognises the importance of effective internal controls and strives to ensure that these are reviewed and improved regularly.

Read more

Control Environment

The Group promotes the use of independent audits in respect of its risk management and regulatory compliance. In addition, the Group strives to ensure that it is operating effective policies and procedures throughout all aspects of its business and these policies are reviewed regularly.

Performance Management and Accountability

The Group applies a rigorous performance management system and ensures that all departments comply with timely reporting. This has been recognised by the Group being awarded an international organisation for standardisation accreditation (ISO 9001). This accreditation is an acknowledgement that the Group meets the needs of its customers and other stakeholders whilst meeting statutory and regulatory requirements related to its products and services.

Ethics and Transparency

The Group recognises that it operates in a sector where small modifications to operating procedure can have enormous impacts on the environment, communities and individuals. It also recognises that, because of its tremendous growth ambitions, its policies will have a global impact. As such, the Group is therefore always mindful of its responsibilities to the planet and to people. It strives to be admired for its integrity, its ingenuity and its diversity.

The Group aspires to be open and transparent about how it operates to earn and retain the trust and confidence of customers, employees, and other important stakeholders. It does this by proactively providing non-proprietary information about its business and how it operates, helping stakeholders to make informed decisions about the company and products.

Tax Strategy

Board approval: 26th February 2018

Scope

This document has been prepared in accordance with paragraph 16(2), Schedule 19 of the United Kingdom Finance Act 2016. It applies from the date of publication until it is superseded.

State Oil Ltd is registered in the United Kingdom and is the ultimate holding company of the State Oil Group. Prax is a trading name of State Oil Ltd and the Prax Group is used to denote all companies within the State Oil Group.

The Prax Group is engaged in the importation, storage, distribution, sale, and integrated supply and optimisation of crude oil and petroleum products.

Read more

Our approach to risk management

Tax risk is the risk that our tax reporting returns or liabilities are inaccurate or incomplete, potentially leading to under or over collection or payment of tax, exposing us to tax authority sanctions as well as potential damage to our reputation. We are subject to the following principal taxes:

- duty on fuel;

- value added tax (or its equivalent) on relevant products and services;

- corporation tax on the profits of our business;

- employer social security contributions on employment costs; and

- income tax and social security contributions from employee remuneration.

We manage tax risk within our Group-wide risk management and governance framework:

- our Board is accountable for risk management and ensures that an effective Risk Management Framework (RMF) is in place, which encompasses tax risk.

- tax strategy and our tax function is part of the finance function.

- we operate an industry standard “three lines of defence” risk management model. Our first line of defence for the majority of our tax risk is our tax function, which owns and assesses tax risk via an annual risk and control self-assessment. The tax function also promotes a culture of good governance, open communication and compliance, and its key objective is to ensure that all tax returns, reports and payments are accurate and complete to the best of our knowledge and filed on a timely basis.

- where tax risk resides in other operating functions across the business, similar risk and control self-assessments are conducted and where key risks are identified, controls are implemented and processes put in place to mitigate those risks.

- our risk and compliance function is the second line of defence, providing oversight and challenge Group-wide, with any material issues being reported to our Board.

- our tax processes and risk governance arrangements are periodically subject to audit, which is the third line of defence, with audit reports provided directly to the Board.

Risk appetite

Our appetite for tax risk is low. Our business model and operating structure is straightforward and not subject to significant judgement in the application of tax law. We do not seek to artificially manipulate our business affairs in order to unreasonably minimise our tax liabilities and aim to pay the right amount of tax in accordance with the spirit of the law in all jurisdictions where we have economic substance.

Our attitude to tax planning

While we will run our business in a cost-effective manner in line with our obligations to our shareholders and clients, in terms of tax, we will only utilise legitimate tax reliefs for the purposes for which they were intended by Parliament. We do not:

- engage in aggressive tax planning;

- seek to structure transactions in an artificial manner whereby results are inconsistent with the underlying economic consequences; or

- promote tax avoidance or condone abusive tax practices which would contravene our ethics and culture or the law.

We believe in safeguarding our reputation and our relationships with clients, shareholders and tax authorities alike and we are not subject to undue shareholder influence.

We will seek external tax advice in certain situations, for example:

- in respect of large, one off transactions such as business acquisitions or disposals, to ensure that we do not suffer any unforeseen or unreasonable tax outcomes;

- in areas where we may have insufficient internal expertise; and

- as a second opinion in cases where we believe there is uncertainty with respect to the application of tax law, although we may also approach HMRC directly, to seek clarity or obtain clearance.

Our approach to dealings with HMRC

- our objective is to build a stable, transparent and professional working relationship with HMRC and other tax authorities.

- we believe in fostering trust and co-operation in our relationships with tax authorities. We value the fact that, as an HMRC defined “large business,” we have a direct Customer Relationship Manager with whom we can proactively engage in dialogue to resolve issues, obtain clarity on aspects of uncertainty and provide early notification of business developments likely to have tax consequences.

- we take a proactive approach and take appropriate action in the event we discover errors or omissions; disclosing to HMRC, implementing remediation as quickly as is reasonably achievable and putting in place measures and controls to prevent recurrence.

Social

Philanthropy lies at the very heart of our business – it is a core value, and acts as a code of conduct, giving every member of staff a sense of pride in belonging to a company that believes in generosity of spirit, thoughtfulness, service, quality, excellence, humility, creativity, and entrepreneurship. We actively promote a culture of generosity and supports a myriad of good causes, in particular, Prax Foundation Roots.

Prax Foundation Roots was formally established as a UK charity in 2022, to continue the charitable initiatives started by our founders in 2010. The name of the charity is inspired by the fact that our founders’ roots are in Sri Lanka, and the charity’s first projects are based there. Currently, the Prax Group is the major donor to the Foundation.

Read More